Aug 26: Tech Giant Forming A Saucer Bottom. Up-Trend Resumes?

Key Macro Indicators May Affect Market Sentiment This Week

Recap

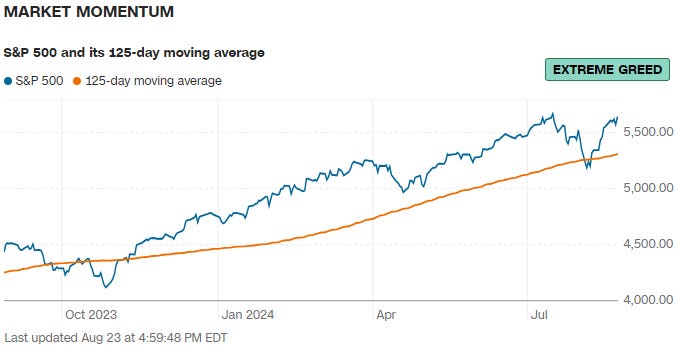

People are finally back from summer vacations and over the last week the market fully returned to up-trend and low-volatility mode.

✅ Our ABBV 0.00%↑ position from the previous publication is very close to the take profit price and I am looking to close it this week.

✅ Our MSTR 0.00%↑ algo trading strategy went nuts and boomed with 3 profitable trades in a row netting +15.14%.

✅ Our CRWD 0.00%↑ algo trading strategy closed a position of previous week netting +6.13%. And gave a new BUY signal, which is currently still in play.

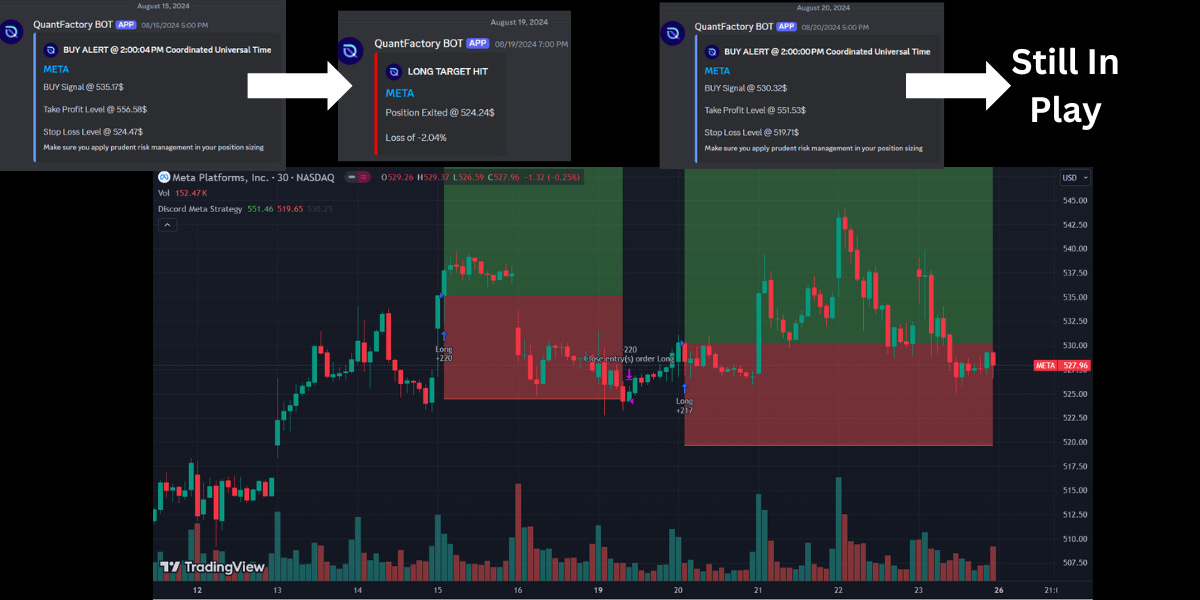

❌ Our META 0.00%↑ algo trading strategy closed a position from previous week with a loss netting -2.04%. However, as well gave a new BUY signal, which is currently still in play.

Overall it was quite an interesting week and after the Japanese Yen trade almost fully unwinded, things look to get more calm again.

⚠️ Look guys if you want to take advantage of all our systems without spending hours on market research, simply join our discord and enjoy daily winning signals as more than 100 other traders already do!

Coming up this week

Several key economic indicators will be released this week which could affect market sentiment:

Tuesday, Aug 27 — Durable Goods Orders are a leading indicator of manufacturing health that is expected to show growth, which can indicate continued economic expansion.

Wednesday, Aug 28 — Federal Reserve Minutes: These are minutes from the last FOMC meeting, where we'll see the central bank's position on inflation and interest rates.

Friday, Aug 30 — Personal Consumption Expenditures (PCE) Price Index: The Fed watches this critical inflation gauge closely, and it may affect future monetary policy decisions.

Furthermore, many significant companies will disclose their results during the course of this week, specifically:

On Aug 28th - CRM 0.00%↑ (Salesforce)

On Aug 28th - NVDA 0.00%↑ (NVIDIA)

On Aug 28th - HPQ 0.00%↑ (HP Inc.)

On Aug 29th - DELL 0.00%↑ (Dell Technologies)

Focus Stock of the Week

This week we are focusing on GOOG 0.00%↑ (Alphabet Inc.) a tech giant in the cloud, search and AI industry.

Over the last year innovative AI initiatives have driven exceptional growth in GOOGL 0.00%↑ in its Search and Cloud segments. The recent earnings call pointed out that Google Cloud has reached a significant milestone and made a robust increase in revenue, which is expected to continue its upward trajectory. This makes it quite attractive investment for anyone looking to have a direct bet on solid AI monetization strategy.

Current Situation and Recent Developments

Strong growth across its core businesses fueled by AI initiatives characterized Alphabet’s Q2 2024 performance. "AI is at the heart of Google's strategy, driving innovation and growth across all its products and services," said Sundar Pichai, CEO of Alphabet. “TPUs” together with some other investments by the company have positioned it for long-term success.

The Gemini model, which has seen wide adoption, is among the leading pointers to Alphabet's AI leadership. According to Sundar Pichai, "Google's AI model named Gemini is used by more than 1.5 million developers and powers features in six of Google's products estimated to impact over 2 billion users." These numbers demonstrate the model's versatility and its ability to drive innovation across various applications.

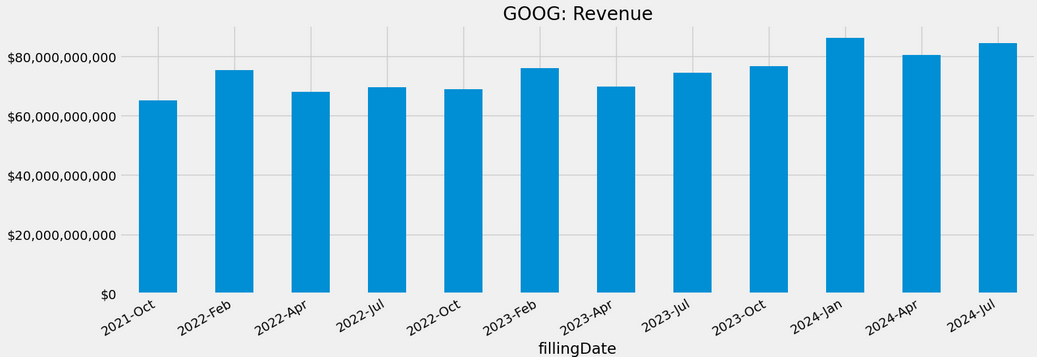

Alphabet's CFO, Ruth Porat, also emphasized the company's strong financial performance over last quarter: "Alphabet achieved $84.7 billion in revenue, a 14% year-over-year increase, fueled by Search and Cloud. "This growth was driven by "strong performance across verticals" in Search and "significant growth" in Google Cloud, which surpassed $10 billion in quarterly revenue for the first time.

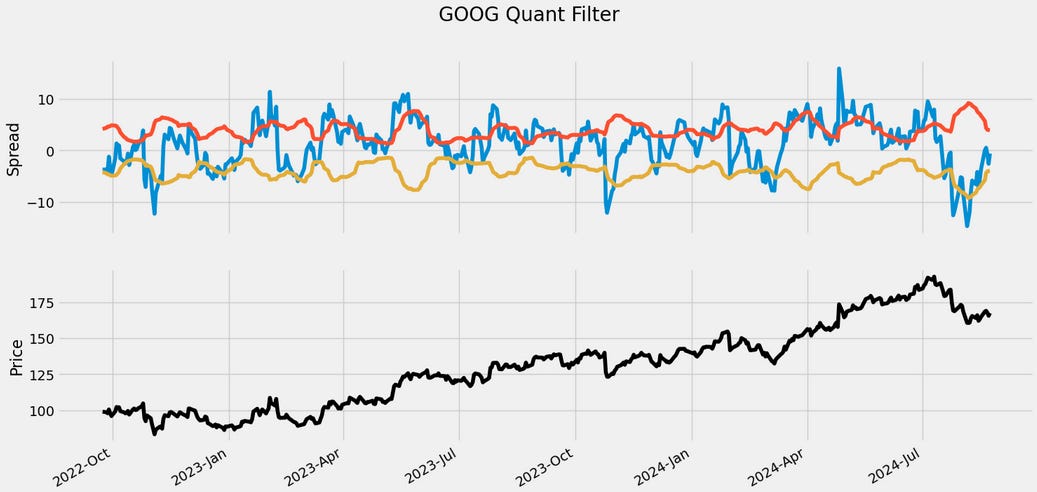

However, this looks to not be yet captured into GOOG 0.00%↑ medium range returns.

Technical Setup

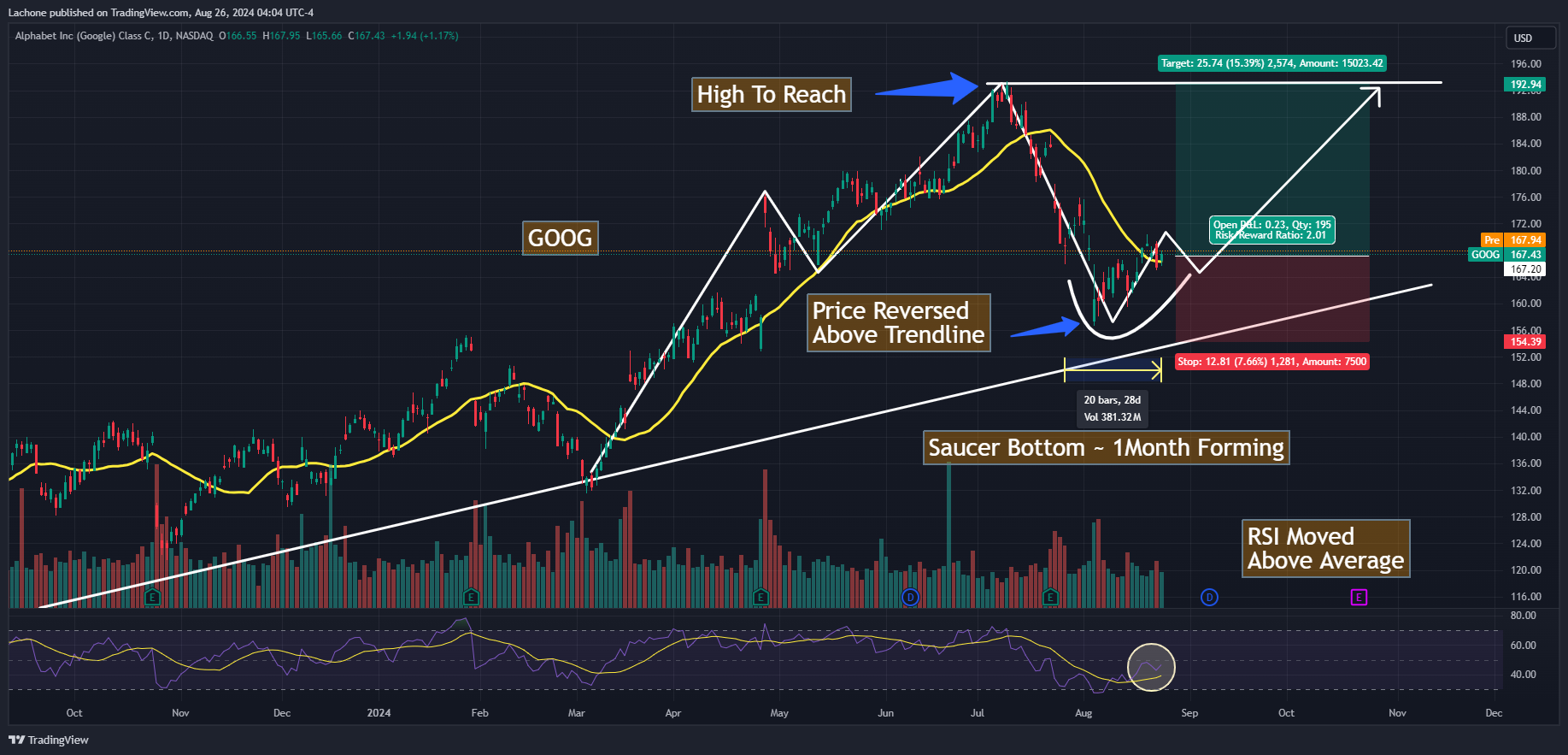

Stock price recently reversed above the long-term uptrend line forming something like a round/saucer bottom.

The figure (bottom) have been forming for around ~ 1 month, which is by the book example of such bottom figure, aka this is a bullish signal.

Additionally, the RSI indicator is rising above its average level, showing a potential momentum upswing.

✅ If my bullish thesis holds, the price would continue rising from here to hit the previous high, or around 15% potential move. Target: $193, Stop Loss: $154

⚠️ However, another possible scenario is that the price shows weakness and corrects again to around the $160 level or the low of the bottom, to form a Double bottom pattern (still on the trend line) and then from there continue upwards.

Fundamentals And Growth Outlook

EPS is standing at $1.89 with expected yearly growth of 13.4%.

Significant factors affecting the EPS include: Advertising Revenue, Cloud Computing and performance of Waymo & Verily investments.

When we plot the P/E Ratio on a TTM basis, a triple bottom appears to have been forming right now around the P/E Ratio of 24.

Revenue is expected to grow by 10% per annum, which is 1.2% more than the average US market company with expected 8.8% per year.

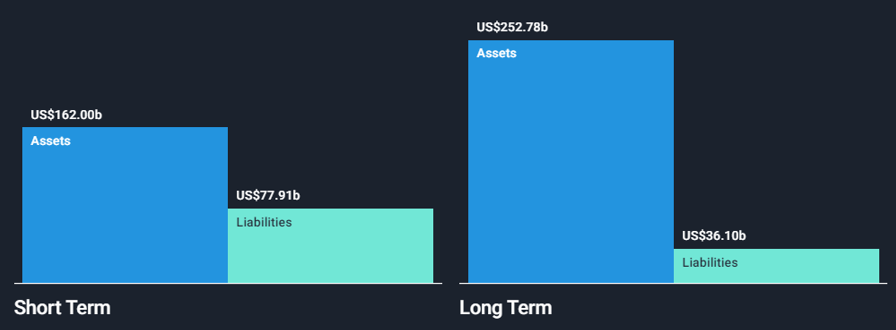

Alphabet's short-term assets ($162.0B) exceed its long-term term ($36.1B) and short-term liabilities ($77.9B) combined.

The company even hoards more cash than its total debts. And interest coverage is also not an issue, as it earns more interest than it pays.

Analyst Ratings And Institutional Buying

On Jul 10th: TD Cowen confirmed Buy rating.

On Jul 24th: Oppenheimer confirmed Outperform rating.

The consensus on Wall Street is decidedly bullish regarding Alphabet (GOOG). Out of the 62 analysts providing ratings, 41 have rated it as a Strong Buy, 9 as a Buy, and 12 as a Hold. Notably, there are no sell ratings at the moment. Furthermore, the current trading price is way below the average and maximum price estimates and is even 2% below the lowest price estimate. This underpins our confidence in the company’s future performance.

Additionally, the latest filings reveal significant new purchases from institutions in July. This inflow of institutional money indicates strong interest and serves as another bullish catalyst.

Institutions such as Vanguard Global Adviser have positive views regarding considerable institution purchases.

Some selling activities may be driven by portfolio rebalancing or profit-taking factors.

Conclusion

Alphabet is showing strong resilience and growth potential, their cloud and advertisement segment are as strong as ever, furthermore their AI initiatives are to bear fruits soon. The recent retrace above a long-term support line, positive momentum indicators, and significant institutional interest further boost our confidence in the company.

You appreciate our work and want to benefit from our advanced trading strategies, or simply wish to connect with a like-minded community? Join us on Discord.

Disclaimer: Please note that the information provided in this article is for general informational purposes only and does not constitute financial, legal, or professional advice. The information provided should not be relied upon as a substitute for financial, legal, or professional advice. Before making any decision, it is important to consider all relevant information and consult with a professional who can provide personalized advice based on your specific circumstances. The author and publisher of this article cannot be held liable for any actions taken based on the information provided. This is not a recommendation to buy or sell any specific securities or financial instruments.